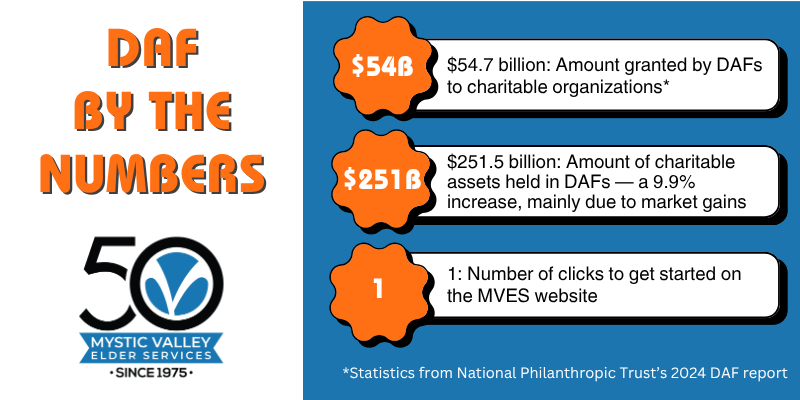

There are many observances during the month of October, but there’s one you may not have noticed. October 9 is DAF Day — Donor-Advised Funds Day. If you’re wondering what a Donor-Advised Fund is, or you could use a refresher, look no further! Mystic Valley Elder Services (MVES) is here to explain how those three little letters can make a profound impact on your community and the MVES mission.

What it is: A donor-advised fund (DAF) is an investment account that’s created expressly to support nonprofits and charities. You create the DAF account through your existing investment firm.

A DAF enables you to donate to a charitable organization of your choice using your stocks, cash or other assets. The organization you donate to must be an IRS-qualified 501(c)(3) public charity, like Mystic Valley Elder Services.

Who can use it: While many DAF donors are individuals, MVES can also accept donations from a trust, corporation, estate or private foundation.

Benefits: DAFs are the fastest growing donation method for several reasons.

- You can recommend donations to eligible charities at any time.

- Donors are immediately eligible for a current-year tax deduction.

- Investment growth within the DAF is exempt from taxes.

- Your investment firm handles all record-keeping, distribution of funds and tax receipts.

- You can choose to have family members involved in your charitable donations and legacy giving.

Ready to Make an Impact?

If you already have a DAF: Visit our Support Our Mission webpage and scroll down to the DAF Direct tool. You’ll select the name of your investment firm and input the amount of your donation.

You can also use the optional “Designation” field if you’d like to support a specific MVES fund or program, such as our Independence Fund or our Meals on Wheels program.

This tool works with Fidelity, BNY Mellon or DAFgiving360/Charles Schwab. If you have a DAF with a different firm, please contact our Development Director Jenny Vanasse at 781-388-4802.

If you don’t have a DAF: If you’re interested in opening a DAF, we encourage you to contact your financial advisor, attorney or tax consultant for personalized guidance.

There are many ways to support MVES’ mission of empowering older adults and people with disabilities to live independently, with dignity, in the setting of their choice. We’ve added the DAF option because many donors value the convenience and tax benefits of giving through a donor-advised fund. In addition, these funds promote strategic giving over time, which is especially impactful for nonprofits like MVES.